Chinese memory chip makers boosted amid coronavirus pandemic

By Zhang Dan Source:Global Times Published: 2020/4/13 12:10:13

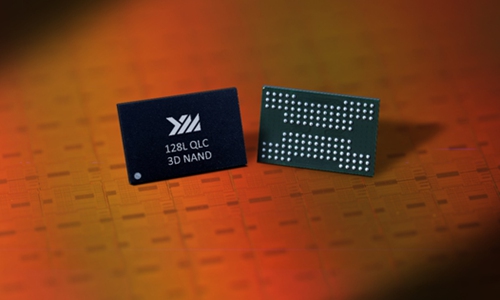

YMTC X2-6070 128L QLC 3D NAND Photo: Courtesy of YMTC

The hotly anticipated 128-layer 3D NAND flash memory chip from Wuhan-based Yangtze Memory Technologies Co (YMTC), one of China's most advanced memory chip companies, passed sample verification on the SSD platform on Monday, boosting China's memory chip industry.Boasting the first QLC-based 128-layer 3D NAND, the 1.33Tb memory chip "X2-6070" has achieved the highest bit density, highest I/O speed and highest capacity among all flash memory parts released in the industry thus far.

"This QLC product will first be applied to consumer-grade solid-state drives and will eventually be extended into enterprise-class servers and data centers in order to meet the diverse data storage needs of the 5G and AI era," Grace Gong, YMTC senior vice president of marketing and sales, told the Global Times on Monday.

YMTC's first phase production lines could reach an overall monthly capacity of 100,000 12-inch wafers. Mass production of the 128-layer chips will be realized later this year or in the first half of 2021.

"All our staff have resumed production and we are speeding up work to catch up with production. In the long term, the coronavirus outbreak will not influence our overall progress," Gong noted.

The encouraging release of the chip means Chinese memory chip makers will see increased opportunities amid the coronavirus pandemic which has brought supply chain disruptions and rising demand for remote working.

Hefei-based Changxin Memory Technologies (CXMT), another leading Chinese DRAM IDM enterprise, is gearing up to mass produce its 10nm-class DRAM chip this year, media report said.

Due to the impact of the coronavirus on semiconductor supply and demand, worldwide semiconductor revenues are forecast to decline 0.9 percent to $415.4 billion in 2020, according to leading research and advisory company Gartner. That forecast is down from the previous quarter's prediction of 12.5 percent growth.

However, semiconductor memory revenue will account for 30 percent of the worldwide semiconductor market in 2020, with the memory market forecast to hit $124.7 billion in 2020 - an increase of 13.9 percent year-on-year.

Non-memory semiconductor markets will experience a significant reduction in smartphone, automobile and consumer electronics production and will be heavily impacted across the board, said Richard Gordon, research practice vice president at Gartner.

"In contrast, the hyperscale data center and communications infrastructure sectors will prove more resilient with continued strategic investment required to support increased remote working and online access," Gordon noted.

The pandemic has led to many around the world working or studying from home, resulting in strong demand for huge data centers.

"In China, lower consumer demand was offset by stronger data-center demand due to increased gaming, e-commerce and remote work activity," Micron Technology Inc. Chief Executive Sanjay Mehrotra said during the company's quarterly earnings conference call on March 25.

He noted that many manufacturers in China had returned to "full production," and that it had "recently started to see China's smartphone manufacturing volumes recover."

Meanwhile, the rapidly spreading pandemic has meant many countries have restricted the exit and entry of personnel, resulting in inevitable blows to leading memory chip makers like Samsung, SK Hynix and Micron Technology, which have factories across the globe.

Gong acknowledged the coronavirus has led to varying degrees of impact for all semiconductor manufacturers and memory chip makers.

"But it also stimulated the online education, remote working, online video and entertainment sectors, which all have increasing memory-related demand for servers and data centers. Thus I see potential opportunities in the industry," Gong said.

Posted in: INDUSTRIES,COMPANIES